Investing with Low Volatility – Being the Calm within the Storm

In today’s uncertain market environment, the low volatility investment style remains a critical tool for investors seeking to preserve capital while maintaining equity exposure. Geopolitical shifts, fluctuating trade policies, and economic uncertainty have fueled volatility, leading to a starkly different market landscape in the first quarter of 2025 compared to the past two years. The year began on the same upward trajectory that closed out 2024, but the "risk-on" rally quickly lost momentum. Markets quickly reversed course as U.S. President Donald Trump’s unpredictable tariff policies triggered "risk-off" sentiment, unsettling global stability.

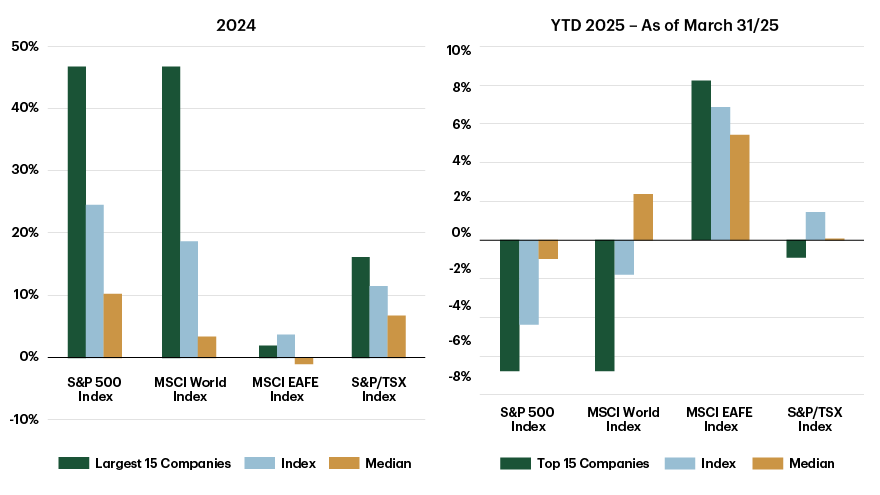

The mega-capitalization (cap) stocks that previously propelled cap-weighted indices higher have now become a drag, pulling markets lower. A notable bright spot has been the Europe, Australasia, and the Far East (EAFE) region, which significantly lagged the U.S. market last year but has so far avoided this year’s downturn, delivering positive year-to-date returns.

Figure 1 – Large-cap players led on the upside in 2024 and the downside in 2025

Source: FactSet Research Systems Inc. As of March 31, 2025.

A steady hand

Strategies that utilize a low volatility approach have provided a steady hand amid the market turbulence, reinforcing their role in capital preservation during volatile periods, and ultimately delivering a smoother return experience. By capturing a portion of the market’s early-year gains while sidestepping the recent downturn, this investment style has demonstrated resilience in navigating today’s unpredictable market conditions.

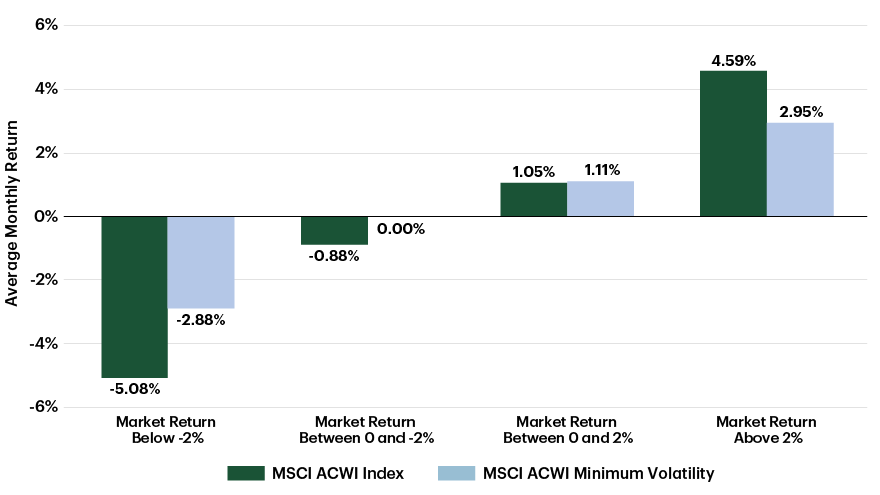

In general, low volatility strategies primarily invest in stable, non-cyclical companies. Because these strategies are constructed to have less risk than a cap-weighted benchmark with the goal of providing better risk adjusted returns, low volatility strategies will tend to lag in strong upward moving markets as seen in 2024 but provide capital preservation by limiting participation in market declines. Low volatility strategies demonstrated resilience during the 2022 drawdown and again in the brief market correction in the third quarter of 2024. The defensive nature of the low volatility style is working to the benefit of its investors in 2025 acting as a calm within a volatile storm. Over the long-term investing cycle, low volatility strategies typically generate much of their relative performance in adverse equity markets as evidenced in Figure 2 where we compare the average monthly returns of the MSCI ACWI Index and the MSCI ACWI Minimum Volatility Index.

Figure 2 – What to expect in up and down markets for a low volatility investor - An average monthly return comparison

Source: Bloomberg Finance L.P. Data from December 31, 1998 to March 31, 2025

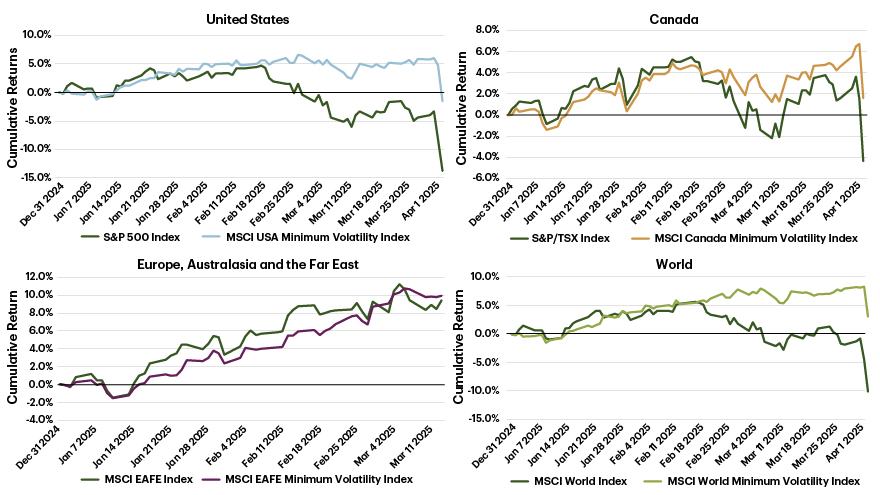

When comparing the year-to-date performance of low volatility indices to cap-weighted indices globally, it is clear that there has been a shift in sentiment and a move towards a de-risking environment. Low volatility indices are continuing to deliver positive returns while global cap-weighted indices are negative. Future market movements will continue to be impacted by the ever-changing tariff landscape.

Figure 3 – Minimum volatility indices are weathering the tariff storm

Source: Bloomberg Finance L.P. Data from December 31, 2024, to April 3, 2025

The certainty of continued uncertainty

The ongoing uncertainty surrounding tariffs, both in terms of scope, implementation, and potential escalation, is contributing to increased market volatility. Historically, such environments have provided an opportunity for strategies employing a low volatility approach to add value, as they are designed to offer potential downside protection during periods of heightened uncertainty. As tariffs are announced and the likelihood of the application of global reciprocal tariffs increases, broad markets tend to react sharply negative. Given their defensive nature, low volatility strategies will typically experience lower downside participation.

This is exactly what low volatility investors experienced over the two trading days of January 31st and February 1st, when the broad Canadian market dropped more than 2% on the U.S. announcement of initial tariff intentions against Canada and Mexico. Overall, trade tensions and tariff-related disruptions can be detrimental to global growth, but such conditions often reinforce the value of investing with low volatility.

In today’s uncertain market environment, the case for low volatility investing remains compelling. By prioritizing capital preservation and risk-adjusted returns, this investment approach can help investors remain disciplined through volatile market cycles. While they may lag in strong upward-trending markets, their ability to cushion against sharp downturns has historically led to better long-term risk adjusted performance. With geopolitical shifts, international trade disputes, and economic uncertainty continuing to weigh on investor sentiment, investing with low volatility can be the calm within the storm and serve as an essential tool for managing risk while maintaining equity exposure. As history has shown, market downturns are inevitable, and having a strategic allocation to low volatility can help investors navigate uncertainty while still participating in long-term growth opportunities.

For institutional investment professionals only. Not for further distribution.

The information contained herein is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax or trading strategies should be evaluated relative to each individual's objectives and risk tolerance.

This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. These materials have not been reviewed by and are not registered with any securities or other regulatory authority in jurisdictions where we operate.

Any general discussion or opinions contained within these materials regarding securities or market conditions represent our view or the view of the source cited. Unless otherwise indicated, such view is as of the date noted and is subject to change. Information about the portfolio holdings, asset allocation or diversification is historical and is subject to change.

This document may contain forward-looking statements (“FLS”). FLS reflect current expectations and projections about future events and/or outcomes based on data currently available. Such expectations and projections may be incorrect in the future as events which were not anticipated or considered in their formulation may occur and lead to results that differ materially from those expressed or implied. FLS are not guarantees of future performance and reliance on FLS should be avoided.

Any indices cited are widely accepted benchmarks for investment and represent non-managed investment portfolios. It is not possible to invest directly in an index. Information about the indices allows for the comparisons of an investment strategy’s results to that of a widely recognized market index. There is no representation that such index is an appropriate benchmark for such comparison. Results for an index do not reflect trading commissions and costs. Index volatility may be materially different from a strategy’s volatility and portfolio holdings may differ significantly from the securities comprising the index.

Bloomberg and Bloomberg.com are trademarks and service marks of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries.

TD Global Investment Solutions represents TD Asset Management Inc. ("TDAM") and Epoch Investment Partners, Inc. ("TD Epoch"). TDAM and TD Epoch are affiliates and wholly-owned subsidiaries of The Toronto-Dominion Bank.

®The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

Related content

More by this Author