Canadian Capital Securities Risk/Return Trade Off

Liquidity is the culprit this time

Typically banks struggle in a downturn because their customers face financial difficulties, which can have implications for both loan performance and deposits. However, in the recent Financials sector turmoil, the problems were driven by deposit flight risk at U.S. regional banks. These issues were unique situations triggered by a combination of (1) a concentrated deposit base to certain struggling industries like technology startups and crypto, and (2) a liability mismatch and over concentration to longer duration fixed income securities that lost more value with interest rate increases than the amount owed to depositors.

Ultimately the headlines scared depositors, and generally, banks with a few large depositors are more at risk than banks with many small depositors, as large depositors know they are not fully covered by deposit insurance.

Canadian Banks were less impacted by the recent crisis

In Canada, the vast majority (approximately 75%) of deposits are with the Big Six Banks (TD Bank, Royal Bank of Canada, Bank of Montreal, Scotiabank, CIBC and National Bank of Canada). The next 20% of deposits are with mid-sized lenders, and not small, regional banks. Due to the smaller number of Canadian banks (around 85 Canadian banks compared to over 4000 banks in the U.S.), regulators are more involved in ensuring minimum capital requirements are maintained and underwriting standards are upheld. This high level of scrutiny made Canadian banks more conservative when it comes to risk taking.

Although Canadian banks operate in a tighter regulatory framework, they were not completely immune to the material decline in equity prices and widening credit spreads that affected the international Financials sector. Market participants started pricing an increased risk of global financial contagion, resulting in heightened concerns and a flight from the Financials sector which caused certain securities to become potentially oversold.

Taking advantage of investment opportunities as they arise.

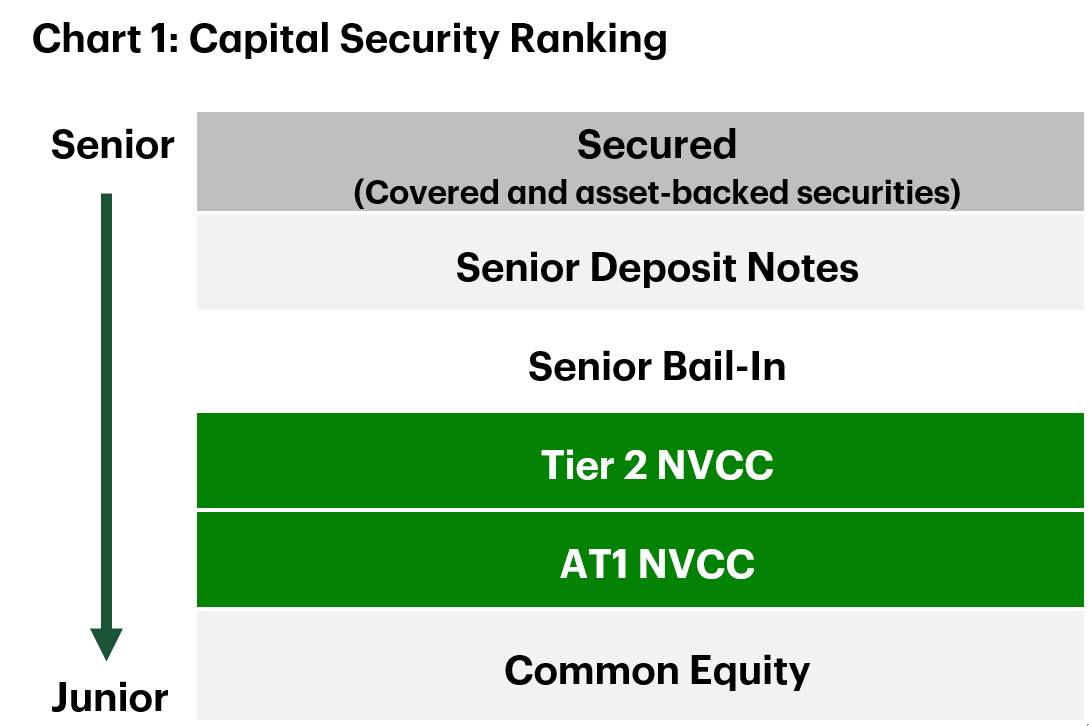

Oversold means an asset is trading below its typical value metrics. The recent financial events in the U.S. and Europe caused Canadian Bank Issued Capital Securities to be oversold, in our view. Capital Securities, mistakenly called non-viable contingent capital ("NVCC") by some, are often misinterpreted to refer to a singular type of security. NVCC is a feature in a variety of capital securities, a feature that forces conversion to equity or is written off in the event that a bank is determined to be "non-viable" by the regulators. These securities rank ahead of common equities and could be pari passu or higher than preferred shares (see Chart 1). For the sake of simplicity, we will use the term "Capital Securities"(or NVCC Securities) to encompass Tier 2 capital and Tier 1 capital (which includes debt instruments such as Additional Tier 1 ("AT1") securities, all of which have an NVCC feature).

Source: TD Securities, As at April 3, 2023.

By investing in Capital Securities, an investor would potentially be compensated for two main risks, (1) Triggering of the Loss Absorption Mechanism and (2) Extension Risk.

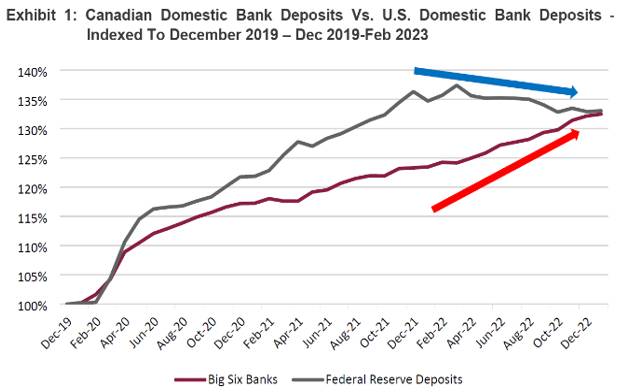

1. When a regulator triggers the Loss Absorption Mechanism by declaring a bank non-viable, the issuing bank's jurisdiction determines whether the regulator can write down or force a conversion to equity.However, we believe that the risk of conversion to equity for Canadian banks is not material since they are generally less risky than their global and U.S. counterparts (due to their tighter regulatory framework). Further to this point, Canadian banks have continued to attract deposits, even while U.S. banks have seen outflows (as shown in Exhibit 1). It is worth noting that Canadian banks typically have a diverse funding base, with well-laddered wholesale debt maturities and a broader customer deposit base, which makes them less susceptible to deposit outflows and reduces the risk of being forced to sell bond holdings at a loss.

Source: TD Securities, As at February 28, 2023.

Additionally, from a Canadian bank asset liability management perspective, while unrealized losses on investment securities recorded at fair value can be considered material, they only represent a very small percentage of Canadian bank's capital.

In the rare event of non-viability, Canadian regulators would not wipe out Capital Securities, but the traditional payment rank would be respected. This stands in contrasts to Switzerland, where Credit Suisse is located, and where it is clearly stated that AT1 contingent convertible capital instruments may be subject to full and permanent write-downs before equity holders are affected. This is simply not the case in Canada, and it makes the likelihood of a Big Six Bank insolvency case low.

2. Extension risk refers to the possibility that the bank differs prepayment due to market conditions.

Capital Securities have call dates, which allow the issuing bank to pay back the principal and avoid extending the instrument beyond the call date (extension risk for investors). This risk is indeed high as interest rates and credit spreads increase and the incentive for the issuer to call back the security decreases because they will need to issue a new one at a much higher yield. If the bank decides not to call, the price of the security will decrease to reflect the new yield to call and time to call, which will occur at a later date. It is important to note that Capital Securities that were issued at a time when risk appetite was high (with lower spread at issuance or commonly known as low reset bonds) will generally be more sensitive to extension risk. As a result, low reset capital securities yield much more than high reset counterparts due to their higher probability of not being called.

Despite the high extension risk, we believe that banks are incentivized to call back the securities to ensure future capital security issuances is met with strong demand as this is an important source of funding for banks.

Taking into account Loss Absorption Mechanism and Extension Risk we believe the current yields offered on Capital Securities are attractive. Canadian Capital Securities' yields increased from an average of 4% to 8% in the last 6 month. We believe these securities are oversold and provide a tactical opportunity for investors. We also currently hold capital securities in our active fixed income strategies, and we are tactically adding to the position.

In conclusion, while recent financial stress has highlighted the vulnerabilities of the banking sector, Canadian banks are more conservative and well managed compared to their global counterparts. We continue to affirm that Capital Securities could be an attractive opportunity within a diversified portfolio, provided an investor understands and is willing to accept the associated risks.

For more information, check out the TDAM Talks Podcast on NVCC Securities

or contact your Relationship Manager.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual's objectives and risk tolerance.

Certain statements in this document may contain forward-looking statements (“FLS”) that are predictive in nature and may include words such as “expects”, “anticipates”, “intends”, “believes”, “estimates” and similar forward-looking expressions or negative versions thereof. FLS are based on current expectations and projections about future general economic, political and relevant market factors, such as interest and foreign exchange rates, equity and capital markets, the general business environment, assuming no changes to tax or other laws or government regulation or catastrophic events. Expectations and projections about future events are inherently subject to risks and uncertainties, which may be unforeseeable. Such expectations and projections may be incorrect in the future. FLS are not guarantees of future performance. Actual events could differ materially from those expressed or implied in any FLS. A number of important factors including those factors set out above can contribute to these digressions. You should avoid placing any reliance on FLS.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts and prospectus, which contain detailed investment information, before investing. Mutual funds are not guaranteed or insured, their values change frequently and past performance may not be repeated. Investment strategies and current holdings are subject to change.

TD Global Investment Solutions represents TD Asset Management Inc. ("TDAM") and Epoch Investment Partners, Inc. ("TD Epoch"). TDAM and TD Epoch are affiliates and wholly-owned subsidiaries of The Toronto-Dominion Bank.

®The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.® The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

Related content

More by this Author