You are now leaving our website and entering a third-party website over which we have no control.

What you need to know about the TD eTreasury® update

ISO 20022 is a significant industry initiative that will help standardize payments and information reporting globally, thereby making your payments more secure and transparent. Many of these enhancements will only impact backend operations at the Bank, but some will impact the way you send Wire Transfers.

Changes as of June 23, 2025:

- Recipient Address lines 1 and 2 are now a required field for all outgoing wires, domestic and international.

- Recipient Country/Region is also now required for all outgoing wires.

How Customers can manage these new required fields:

- The Address and Country fields must be properly populated in Recurring and Future-dated wires to prevent rejections. These fields should also be provided for Stored Recipients and Wire Templates, or an error message will be displayed when you try to use them. Please note that when you update Stored Recipients, any templates using them will automatically be updated.

- As an additional reminder, some special characters are no longer allowed in Recipient ID, Bank to Bank Info, and Sender to Receiver Info; please review the FAQs further down this page for more details under the "How do I work with these changes?" topic.

What's new, what's changing

TD eTreasury update FAQs

It is a standard introduced by The International Organization for Standardization (ISO) to structure, extend, and enrich the data exchanged in the electronic messages between Financial Institutions. FedWire is adopting these standards across all wire payments, including domestic and international.

- As of June 23, 2025, the Address Lines 1 and 2 and Country fields are required for all outgoing wires. Instructions to update each of these is linked here: How to update your Recurring and Future Dated Wires, How to update your Stored Templates, How to Update your Stored Recipients.

- Please note restrictions on the use of Special Characters in these fields:

- Recipient ID, Bank to Bank Info, and Sender to Receiver Info fields do not allow the use of these commonly used characters:

- & ! $ # % ; _ @ " ` ~ < > = { } * | [ ] ^

- Recipient ID, Bank to Bank Info, and Sender to Receiver Info fields do not allow the use of these commonly used characters:

You can contact us at 1-866-475-7262; available Monday - Friday 7:30-8 ET, Saturday: 9-1:00 ET, Sunday: closed, or by email tmss@td.com

The beneficiary (recipient) should be able to provide their full wire instructions, including the proper address. Please reach out to the beneficiary for their address and country.

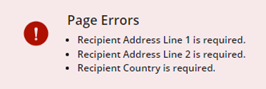

Once Address and Country fields become required, the below validation message will prevent you from submitting the wire without Recipient's Address and Country.

Please follow this link for more information https://www.td.com/us/en/commercial-banking/iso-20022