Customer Feedback

Striving to deliver legendary customer experience, each and every time

TD employees strive to connect with customers during every interaction and have a positive impact on the customer’s experience. We measure our success in meeting our clients’ needs both formally and informally.

- Customer experience – what is required to deliver a legendary customer experience during each and every interaction with TD.

- Handling complaints – when, despite our best intentions, we make mistakes, we make every effort to recover with grace and respect.

- Customer retention – understanding why customers leave and why they stay.

Customer Experience

We ask our customers to give us feedback so that we can assess our performance on an ongoing basis. In 2009 we conducted over 600,000 interviews. We evaluate our performance through our Customer Experience Index (CEI) in Canada and our Customer WOW! Index (CWI) in the U.S. We use these indices to set targets and drive improvement; the results have an impact on employee compensation.

CEI and CWI measure our customers’ likelihood to recommend TD to their family, friends or colleagues. We also ask respondents to rate our performance in a number of areas, such as:

- Showing we value our customers.

- Listening carefully to understand our customers’ concerns and questions.

- Providing prompt responses to requests.

- Showing genuine interest in helping our customers.

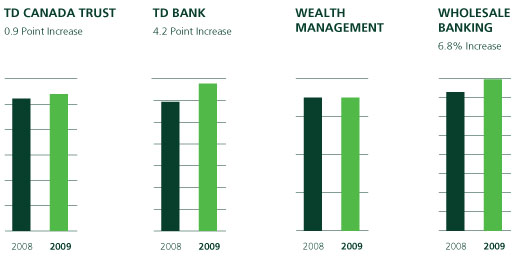

Customer Experience Index Scores for 2009

We set our 2009 CEI targets as equal to, or greater than the 2008 targets. We did this in order to challenge ourselves to be the better bank even in tough times. All of our businesses maintained or improved their performance compared to the previous year.

Handling Complaints

Listening and responding to customer complaints helps us get better – and reflects an approach to treating people with respect. Each of our businesses is responsible for problem resolution and has internal processes in place to ensure that complaints are welcomed and addressed in a consistent and timely manner. We are transparent with our problem resolution process, with information readily available on our website and in retail locations. Most problems are resolved upon initial contact.

In the U.S., TD Bank strives to resolve 80% of complaints referred to a higher level of management within three days or less. Since August 2009, 77.4% of the referred complaints were resolved within that time frame. In Canada, we do not currently track an equivalent measurement.

Canadian customers can contact the internal TD Office of the Ombudsman, which acts as an independent intermediary, striving to resolve all problems fairly and impartially. Furthermore, the federal government sponsors an office of the Ombudsman for Banking Services and Investments, which may be contacted if a customer’s concern remains unresolved.

| Handling Complaints (Canada) | |||

| 2007 | 2008 | 2009 | |

| Complaints investigated by TD Ombudsman | 230 | 234 | 338 |

| Complaints in which TD Ombudsman ruled in full or partial agreement with the customer or client | 94 | 112 | 160 |

| Complaints referred to external industry ombudsman (OBSI) 1 | 25 | 23 | 154 |

| Complaints investigated in which external ombudsman made recommendations in favour of customer or client | 5 | 12 | 30 |

1The Ombudsman for Banking Services and Investments (OBSI) changed its criteria for case reporting effective 2009. For this reason, 2007 and 2008 numbers do not provide a true statistical comparison of our performance in handling complaints.

Responding to IRD

Whenever interest rates decline, we see an increase in customer complaints regarding the issue of mortgage prepayment charges, and, more specifically, interest rate differential (IRD). IRD is the amount that would have been paid to the bank in interest, had the customer remained in the mortgage contract until the end of the term. Since the rate is set for the contract term, there is a real cost to the bank when the term in broken and IRD cannot be easily waived. This is an industry wide issue.

As IRD is complicated to explain, we have increased efforts to educate our employees with training aids and communications. We’ve also learned that even if expectations have been set appropriately at the time when the mortgage agreement is signed, IRD is and will likely continue to be a difficult message for our customers to hear. We are continuing our efforts to support our employees, share best practices across our retail network and help our customers through a challenging transaction.